Compare OFX vs Wise: How do they Work?

To send money using OFX, go to the website and sign in. You then enter the transfer amount. You may deposit funds into an OFX account for transfer or link your bank account for a direct transfer, which means that OFX will withdraw the money for you. OFX will then convert the currency and send it to a recipient who receives payments via bank transfer.

To send money using OFX, go to the website and sign in. You then enter the transfer amount. You may deposit funds into an OFX account for transfer or link your bank account for a direct transfer, which means that OFX will withdraw the money for you. OFX will then convert the currency and send it to a recipient who receives payments via bank transfer.

OFX allows you to move money from one bank to another using the phone or online. If you do it over the phone, it is 24/7, and you’ll come across a “dealer” who can answer any questions and ensure that everything goes according to plan.

Most individuals, on the other hand, do their banking entirely online, and in this case, you will discover a simple yet effective platform. However, when dealing with large amounts of money, extra assistance is occasionally required for various reasons, mainly owing to the banks involved. So because of the assistance from these friendly dealers, OFX is recommended for sending massive amounts.

How Wise Works

By providing a straightforward application, Wise makes it easy for you to send money directly between banks. Their excellent online platform with phone support allows you to manage bank-to-bank transfers. Their low fees make them especially appealing for smaller amounts in conjunction with great client service and transparent pricing.

They also provide a sleek and user-friendly online experience, from sign-up to transfers, making it a pleasure to utilize.

Simply use the app or website to choose your currencies and how much money to transfer. Wise will then break down the costs and charges for the transaction, providing transparency! The cash will be taken from your account and delivered to the recipient after approval and confirmation.

Wise also allows you to transfer money to a multi-currency account. You can then divert funds in over 50 currencies and convert them between currencies inside the account.

OFX vs Wise: Transfer Fees

OFX Fees

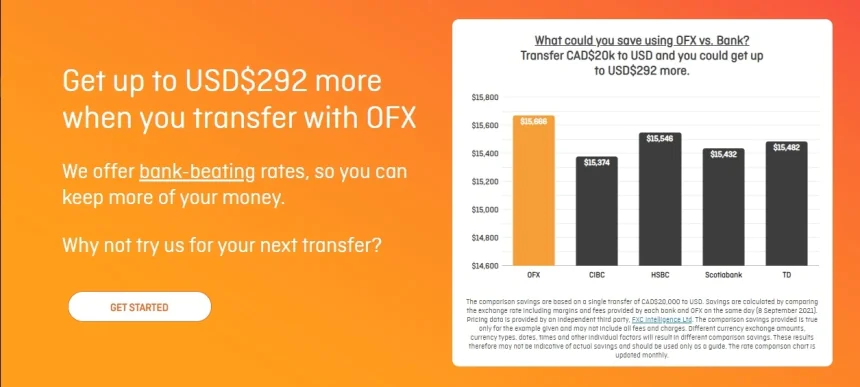

OFX charges no transaction fees. Thus, if you frequently move funds across borders, this can save you a lot of money.

However, a third-party bank may charge a fee for the transfer. OFX has no power over whether or not they charge you a fee; thus, it can’t do anything about it.

Wise Fees

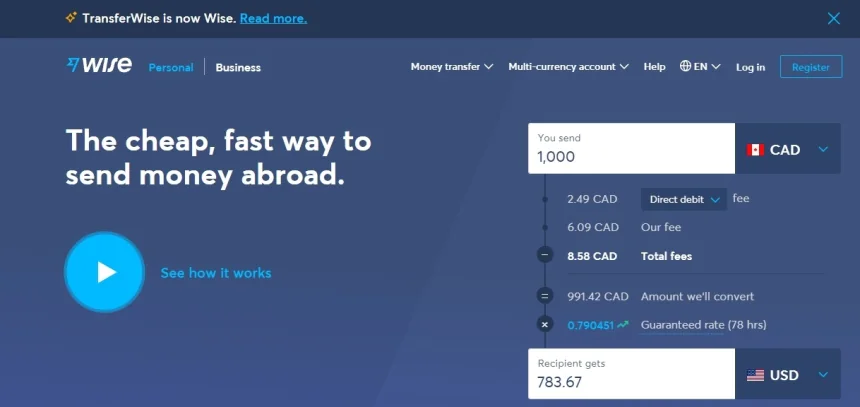

The costs you may anticipate paying when sending money with Wise differ based on several variables.

Some of these variables are: How much money you’re transferring? The country you’re sending the money to and whether you’re using a bank account, debit card, or credit card to fund the transfer.

Wise fees are clearly stated, and you’ll always be able to determine how much you’ll be charged before completing your transaction.

Verdict: Wise Wins

Although OFX has no transfer fees, third-party banks may charge additional fees, and the recipient may receive less money as a result. The disadvantage of this is that you will not anticipate how much you will pay for an international money transfer ahead of time.

Wise charges a modest, transparent fee for each transfer, and you’ll always know the exact amount you’ll pay before.

OFX vs Wise: Exchange Rates

The mid-market or interbank rate should serve as a reference point when it comes to foreign exchange rates.

The mid-market rate is the midway point between the buy and sell prices of a currency pair’s pair. This rate serves as an excellent baseline for OFX vs Wise comparisons.

OFX Exchange Rates

OFX charges a typical margin of 0.4 percent above the mid-market rate. However, you may get margins of around 0.8% to 1.2% when transferring amounts between $5,000 and $50,000.

Once you’ve decided on the exchange rate, OFX locks it in for the duration of the transaction to protect you against currency fluctuations.

Wise Exchange Rates

Wise does not charge a margin on exchange rates. All conversions are done at market mid-market rates. Compared to other money transfer services and alternatives, Wise’s market mid-market rate makes them highly cost-effective. When sending funds through Wise, you can expect similar pricing as your bank.

You may secure your exchange rate with Wise when sending money to specific countries. Depending on where you’re sending money, you have between 24 and 48 hours from when you set up your transfer to pay for it in full. If you start your transfer on a Friday, your exchange rate will be held for the whole weekend.

You will be charged the mid-market rate if you do not fully pay your transfer by the end of the secured period. Because this price fluctuates, you may find yourself paying more or less than you anticipated when making the transfer.

Share

What was your reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0