Bank of America Credit Cards: Extra 2% Rewards on Thursday, November 6, 2025

Bank of America is bringing back its popular “More Rewards Day” for 2025 on Thursday, November 6th. On this one-day promotion, eligible BofA credit cards—including both personal and business cards—can earn an extra 2% cash back

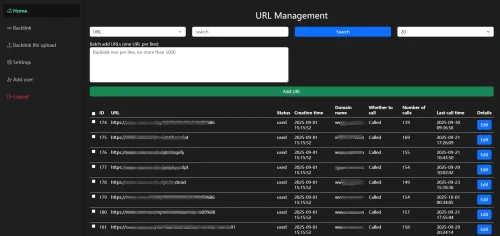

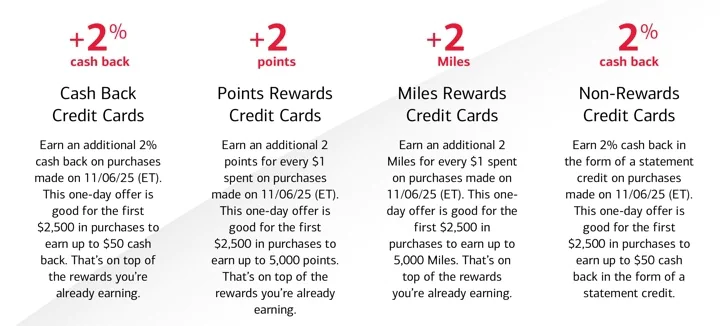

Bank of America is bringing back its popular “More Rewards Day” for 2025 on Thursday, November 6th. On this one-day promotion, eligible BofA credit cards—including both personal and business cards—can earn an extra 2% cash back, points, or miles per dollar spent on up to $2,500 in purchases (Eastern Time). This bonus is added on top of your regular rewards, with a maximum of $50 or 5,000 points per card. No enrollment is necessary to participate.

Eligible cards include:

Customized Cash Rewards

Unlimited Cash Rewards

Travel Rewards

Premium Rewards®

Premium Rewards® Elite

BankAmericard® Power Rewards®

BankAmericard Rewards®

MERRILL+®

MERRILL+® Elite

Atmos™ Rewards Ascent

Atmos™ Rewards Summit

Royal Caribbean®

Celebrity Cruises®

Norwegian Cruise Line

Beaches

Sandals

Free Spirit®

Allegiant

Air France KLM

BankAmericard®

You can get up to a $50 bonus on each of your unique BofA credit cards. Note that it expires 11:59pm in the Eastern time zone. It appears that somehow they can track the “transaction date” separately from when it posts to your statement. Note that some retail websites don’t actually charge you until a physical item ships.

Only Purchases that post to your account and appear on your statement with a transaction date of 11/06/2025 will qualify. Merchants may impact when a transaction will appear on your statement, particularly if they delay processing of the purchase. Transactions with delayed processing of 90 days or more will not be eligible to be included in the promotional offer.

Some possibilities beyond timing the normal bonus categories on your unique cards:

- Pay estimated income taxes at PayUSATax.com for currently a 1.75% fee.

- Pay your insurance premiums upfront. My State Farm grouped monthly bill can also be timed using manual payment.

- Pay your utilities, property taxes, phone bills, and other monthly bills upfront. Sometimes it just costs a one-time flat fee to pay by credit card, which can be worth if you are charging $1,000+.

- Make your annual charitable contributions for this year on this date.

Share

What was your reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0