Capital One VentureOne Credit Card [Updated 2025.12: 40k+ $100 Sign-up Bonus]

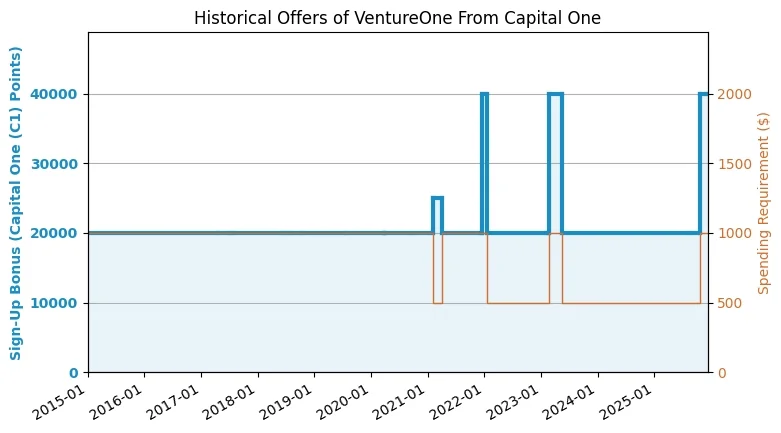

Capital One VentureOne Rewards Credit Card Overview [Updated 2025.12] The new sign-up bonus is 40k+$100, the highest ever! HT: DDG.

Capital One VentureOne Rewards Credit Card Overview

[Updated 2025.12.7] The new sign-up bonus is 40k+$100, the highest ever! HT: DDG . [Update] The

Application link

feature

- 40,000+ $100 Sign-up Bonus: Earn 40,000 Capital One Miles by spending $1,000 within the first 3 months of opening the account. You'll also receive a $100 credit on Capital One Travel, valid for one year. This is the best bonus ever for this card.

- Earn 5x cashback on hotel, vacation rentals, and car rentals booked through the Capital One Travel portal; earn 1.25x cashback on all other purchases.

- Capital One Miles points have a combined value of 1.6 cents per point, as detailed below.

- No Foreign Transaction Fee (FTF)。

- No annual fee.

shortcoming

- When applying for a Capital One visa, you will receive three pulls from three credit bureaus, leaving you with three hard pulls.

Capital One (C1) Miles Points Introduction

- There are two main types of credit cards that allow you to accumulate C1 points: points cards and cashback cards. Points cards include: Capital One Venture , Capital One VentureOne , and Capital One Spark Miles (business card) . Cashback cards include: Capital One Savor , Capital One SavorOne , Capital One Quicksilver , and Capital One Spark Cash Plus (business card) , among others.

- C1 points accumulated on each C1 points card can be transferred to another C1 points card at any time, and cashback accumulated on each C1 cashback card can also be transferred to a C1 points card to become points and increase their value. However, note that C1 points cannot be transferred to a cashback card to become cashback, therefore, C1 cashback is more flexible than points.

- C1 points never expire. Levels will cause the accumulated C1 points on a card to disappear, but you can simply move the C1 points to another C1 card beforehand.

- With a C1 points card, C1 points can be converted into airline miles and hotel points. One of the most common and cost-effective uses is a 1:1 conversion to Air Canada (AC) (Star Alliance), Avianca (AV) miles (Star Alliance), Asia Miles (CX) (Oneworld), British Airways (BA) (Oneworld), and Wyndham Hotel points . This conversion yields points worth approximately 1.6 cents per point.

- C1 points can be used to reimburse travel expenses at a fixed rate of 1.0 cent/point or redeem gift cards from some merchants.

- C1 points can be directly exchanged for cash at a fixed rate of 0.5 cents/point.

- In summary, we give C1 a total valuation of approximately 1.6 cents/point.

- For more information on the C1 points system, see " Introduction to the Capital One (C1) Miles Points System ").

Recommended application time

- It is recommended to have a credit history of more than two years, confirm that you have a certain understanding of credit cards, and open most of the good cards available before applying for a card from a bad bank.

- 【New】 【48-month rule】If you have received a sign-up bonus from VentureOne , Venture , or Venture X within the past 48 months , you are ineligible to apply for this card again.

- [1/6 rule] You can only apply for one Capital One card within a 6-month period, including personal and business cards. Violating this rule will result in immediate rejection without a hard pull.

Summarize

For a no-annual-fee card, the sign-up bonus is decent. If you're interested in the C1 points system, the Venture or Venture X cards, which have annual fees, offer higher sign-up bonuses and the Everything 2x card provides stronger points accumulation. The main advantage of this VentureOne card is its no-annual-fee nature, making it a stress-free long-term option and a good downgrade choice. However, be aware that Capital One pulls from three credit bureaus simultaneously, making approval difficult. Those with multiple cards may find it hard to get approved, so proceed with caution.