BoA Customized Cash Rewards Credit Card [Updated December 2025: $200 sign-up bonus + 6% cashback on your choice of categories in the first year + FIFA World Cup ticket purchase rights]

Bank of America Customized Cash Rewards Credit Card (BoA 123) Credit Card Overview [Updated December 2025] In addition to the usual sign-up bonus, applying for this card between December 4, 2025 and January 5, 2026 will also grant you the right to purchase tickets for the 2026 FIFA World Cup (see this official website page for details).

Bank of America Customized Cash Rewards Credit Card (BoA 123) Credit Card Introduction

[Updated 2025.12] In addition to the usual sign-up bonuses, applying for this card between December 4, 2025 and May 1, 2026 will also grant you the right to purchase tickets for the 2026 FIFA World Cup (see this official website page for details ). Tickets can be purchased on February 10, 2026. Those interested in the World Cup might find this useful.

Application link

- BoA Customized Cash Rewards (Standard Version )

- BoA Customized Cash Rewards Student Edition . Note: Aside from the sign-up bonus, there are no differences in benefits between the student and regular editions. Students are advised to apply for the student edition, while non-students should apply for the regular edition.

feature

- $200 Sign-up Bonus: Earn $200 by spending $1,000 within 3 months of opening the card. Note that this sign-up bonus is only available for online applications; there is no bonus for in-store applications. The maximum sign-up bonus for this card is $200.

- Choose one of the following categories to receive 3% cashback:

-

- (online shopping) + cable/streaming/internet/phone plan

- Have a meal

- travel

- Refueling + Electric Vehicle Charging

- pharmacy

- home improvement/furnishings

Online shopping covers the widest range of categories and is highly recommended (please visit the official website for specific merchants ).

-

- Supermarkets and wholesale clubs get 2% cashback; other categories get 1% cashback.

- BoA Preferred Rewards Account Tier Bonus: If you have a BoA checking account and your assets in your BoA bank account + Merrill Edge investment account reach a certain tier, you can receive bonuses. Gold tier (requires assets over $20k) receives an extra 25%; Platinum tier (requires assets over $50k) receives an extra 50%; Platinum Honors tier (requires assets over $100k) receives an extra 75%.

- You can apply even without a credit history! The only prerequisite is that you need to have a certain amount of money in your Bank of America (BoA) Checking Account. It is recommended that those with zero credit history apply at a branch.

- No annual fee.

shortcoming

- The 3% and 2% categories have a combined quarterly spending cap of $2,500. Once this cap is exceeded, the cashback rate drops to 1%. (Note: The quarterly cap is calculated based on the post-date.)

- Foreign Transaction Fee (FTF) exists, so don't use it outside the United States.

Recommended application time

- You can apply without a Social Security Number (SSN) or a credit history! If you have no credit history, it is recommended to apply at a bank counter.

You can hold multiple identical BoA credit cards at the same time. There must be a 90-day interval between applications for the same card; otherwise, the application will be automatically cancelled.[New] If you are currently holding this card, you will not be able to apply for this card unless you have held it for more than 24 months.- 【New】【2/3/4 Rule】A maximum of 2 BoA cards can be approved within 2 months; a maximum of 3 BoA cards can be approved within 12 months; and a maximum of 4 BoA cards can be approved within 24 months. BoA's IT system is still relatively poor, so this rule may not reject you initially. However, it's possible that your card might be approved initially, but then closed a few days later with the reason "approved in error."

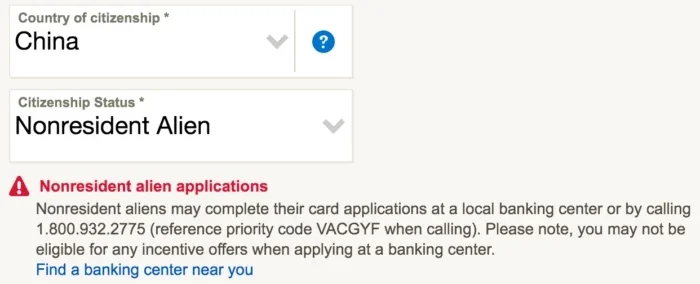

- Theoretically, only US persons (see " Tax Filing Identity Verification ") can apply for BoA credit cards online. If you are a Non-Resident Alien (NRA), you need to apply by phone or in person at a local branch. In practice, the bank doesn't actually verify whether you are a US person; NRAs can also get approved online, but at their own risk.

Summarize

The 3% cashback on online purchases in this card's cashback structure is quite good, with a very wide range of options, although the maximum cashback is relatively small. As a credit card that can be applied for without a Social Security Number (SSN) and zero credit history, it's still worth applying for! When applying without a credit history, you must go to a branch. Note that if you apply through a branch, you won't get the sign-up bonus. However, as this is your first card, don't worry too much about the sign-up bonus; wait until you have enough credit history to apply for a credit card with better returns.

If you have a lot of assets and can put $100k of stocks/funds in Merrill Edge, then after getting a 75% bonus, the original 3% cashback will become 5.25% cashback, which is a pretty high return. Therefore, this card can be very effective not only as a beginner card but also in the later stages.

This card has several "aliases".

The following credit cards offer the exact same benefits as this card, but BoA treats them as separate cards. Therefore, if you're interested, you can apply for all of them as long as you meet BoA's " Rule 2/3/4 ". The advantages of applying for these "alternative" cards, besides receiving more sign-up bonuses, include a correspondingly increased 3% category cashback cap.

- BoA MLB® Credit Cards

- BoA U.S. Pride® Cash Back Credit Card

- BoA Susan G. Komen® Cash Back Rewards Visa®

- World Wildlife Fund Bank of America® Cash Rewards Visa® credit card

![[YMMV] American Express Blue Business Plus 75,000 Points Signup Bonus (No Lifetime Language)](https://ceacer.com/uploads/images/202512/img_w860_6938c355bbb444-26195744.webp)