TD Bank $300 Checking & $200 Savings

Update 12/6/25: Deal is back until January 31, 2026 Offer at a glance Maximum bonus amount: $500 Availability:CT, DC, DE, FL, MD, ME, MA, NC, NH, NJ, NY, PA, RI, SC, VT, & VA Direct deposit required: Yes, $500+ for $150...

Update 12/6/25: Deal is back until January 31, 2026

Offer at a glance

- Maximum bonus amount: $500

- Availability:CT, DC, DE, FL, MD, ME, MA, NC, NH, NJ, NY, PA, RI, SC, VT, & VA

- Direct deposit required: Yes, $500+ for $150 bonus or $2,500 for $300 bonus

- Additional requirements: See below

- Hard/soft pull: Soft

- ChexSystems: No

- Credit card funding: None (a lot of cards process as cash advance)

- Monthly fees: Up to $25, waive-able

- Early account termination fee: Six months, bonus forfeit

- Household Limit: None mentioned

- Expiration date:

March 13th, 2019May 8th, 2019September 18th, 2020March 31, 2021January 1, 2025January 31, 2026

The Offer

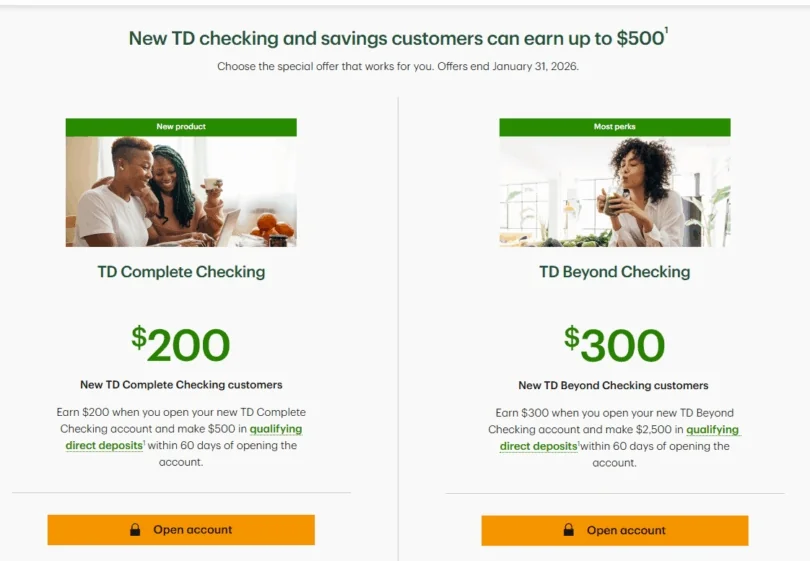

- TD Bank is offering a bonuses of up to $500, bonuses are broken down as follows:

- $300 TD Beyond Checking Bonus

- Open TD Beyond Checking account and make $2,500 in direct deposits within the first 60 days

- $200 TD Complete Checking:

- Open TD Complete Checking account and make $500 in direct deposits within the first 90 days

- $200 TD Signature or Simple Savings account Savings Bonus:

- Deposit $10,000 or more in new money within 20 days and maintain that balance for 90 days

- $300 TD Beyond Checking Bonus

The Fine Print

- Checking Bonus: You will not qualify for the Checking Bonus if you are an existing TD Bank personal checking Customer OR had a previous personal checking account that was closed within the preceding 12 months OR have received a prior personal checking account bonus at any time. Your direct deposits need to be an electronic deposit of your paycheck, pension, government benefits (such as Social Security) from your employer or the government of at least $250 each. Person-to-Person and bank transfers between your TD Bank accounts or accounts you have at other financial institutions or brokerages are not considered a direct deposit.

- Savings Bonus: You will not qualify for the Savings Bonus if you are an existing TD Bank personal savings or money market Customer OR had a previous personal savings or money market account that was closed within the preceding 12 months OR have received a prior personal savings or money market account bonus at any time.

- After you have completed the requirements outlined within, we’ll deposit the bonus in your new account on or before 180 days of account opening. To receive the bonus, your account must not be closed or restricted at the time of payout. If your new checking and/or savings account is closed by you or TD Bank within 6 months after account opening, and the bonus has been paid, TD Bank reserves the right to deduct the bonus amount at closing.

- Eligibility may be limited based on account ownership. The primary owner of the new personal checking and/or new personal savings account may be required to complete a valid IRS Form W-9 or substitute IRS Form W-9 to provide certain identifying information. You may be subject to backup withholding at the rate specified in the U.S. Internal Revenue Code if you fail to provide that information or meet certain other conditions. TD Bank may issue you an IRS Form 1099 or other appropriate forms reporting the value of the bonus.

Avoiding Fees

TD Complete Checking ($200 Bonus)

This account has a $15 monthly fee that is waived if you do any of the following:

- Have $500 or more in direct deposits within a statement cycle

- Maintain a minimum daily balance of $500

- Have a $5,000 minimum daily combined balance across all personal deposit accounts that you choose to link

TD Beyond Checking ($300 Bonus)

This account has a $25 monthly fee that is waived if you do any of the following:

- Have $5,000 or more in direct deposits within a statement cycle

- Maintain a minimum daily balance of $2,500

- Have a $25,000 minimum daily combined balance across eligible TD accounts you choose to link

Early Account Termination Fee

In their online fee schedule, there is no mention of an early account termination fee. The fine print does say the accounts need to be kept open for 6 months or the bonus is forfeit though.

Our Verdict

Previously this was targeted, now it’s available in selected states. In fact you can do this bonus even if you’ve done a TD Bank bonus before (new terms added mean this is no longer possible). Savings bonus should be worth doing as you only need $10,000 in the account for 90 days and no monthly fee to worry about in the first year. That works out to be an effective interest rate of 8%+. The checking bonus is also worth doing.

We will add this to our list of the best bank account bonuses.