The Coin Flip Experiment: Why Smart Bet Sizing Determines Your Survival in Volatile Markets

In Missing Billionaires, authors Victor Haghani and James White explore why, despite the exponential force of compounding, the world doesn’t have as many billionaires as it should. The real problem isn’t poor portfolio allocation—it’s bad risk management.

In Missing Billionaires, authors Victor Haghani and James White explore why, despite the exponential force of compounding, the world doesn’t have as many billionaires as it should. The real problem isn’t poor portfolio allocation—it’s bad risk management. Many investors lose their edge by taking outsized bets or overspending, which forces them into even riskier gambles to recover. This “coin flip challenge” highlights how mastering position sizing and surviving volatility are far more critical to long-term wealth than chasing the perfect investment mix.

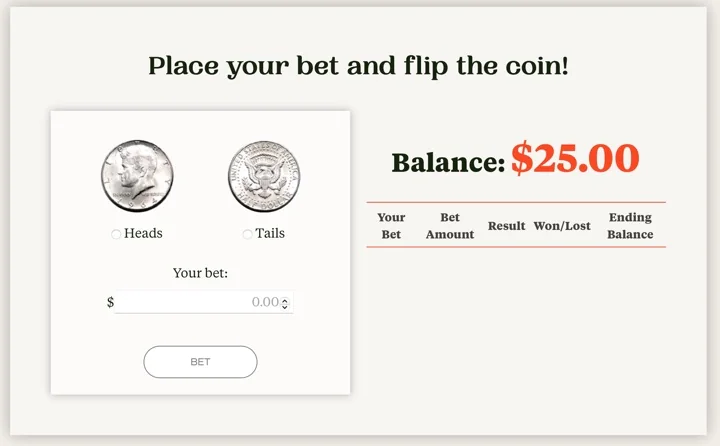

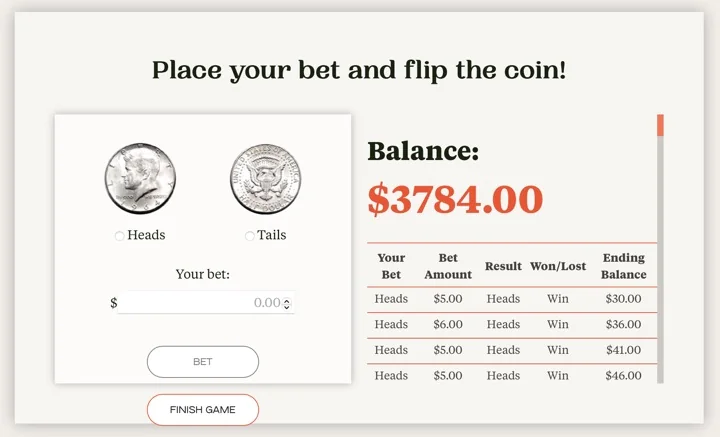

For example, one simple way that you can lose money even with the odds in your favor is poor bet sizing. The authors created the Elm Wealth Coin Flip Challenge in order to teach this interactively. In the game, the coin is altered such that you know it will come up heads 60% of the time, and tails 40% of the time. If you know anything about gambling in the real world, you’ll know this is a huge advantage! Dramatic movies about card counting and the MIT Blackjack team involves edges of only ~1%.

You get $25 to wager, and you can bet any amount you have. Can you build your stack up to thousands of dollars? Try for yourself, first with just your intuition. You’ll soon discover that it’s harder than it looks! Too little a bet, and the needle doesn’t really move much even on the good swings. Too big a bet, and you can’t survive the bad swings. It’s quite easy to dwindle quickly down to zero. After that, as Warren Buffett has stated, “Anything times zero is zero.”

Nowadays, we all have a 24/7 casino lurking in our pockets. With ads constantly telling us we can get rich with crypto, stock options, and sports betting, I think it’s very critical to teach ourselves and our kids about these concepts like odds and betting. Warren Buffett once bought and installed slot machines in his own house, to teach his kids about the one-armed bandits. Investing done right with proper risk management is a positive-sum game with excellent odds for the investor. Crypto speculation, aggressive use of stock options, and sport betting are only excellent for the “house” and I fear will create a generation of missing wealth. The next wave of volatility will come soon enough.

Share

What was your reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0