Chase Ink Business Preferred (CIP) Card – November 2025 Update: 100,000-Point Sign-Up Bonus & New Application Limit

In November 2025, the Chase Ink Business Preferred card is offering a 100,000-point bonus—but it now includes a once-per-lifetime restriction. Learn how to apply, if you qualify, and why this is a rare opportunity.

Chase Ink Preferred Business Card: Business Credit Card Introduction

[Updated 2025.11] " The new cardmember bonus may not be available to you if you have ever had this card. "

Application link

https://creditcards.chase.com/business-credit-cards/ink/business-preferred

feature

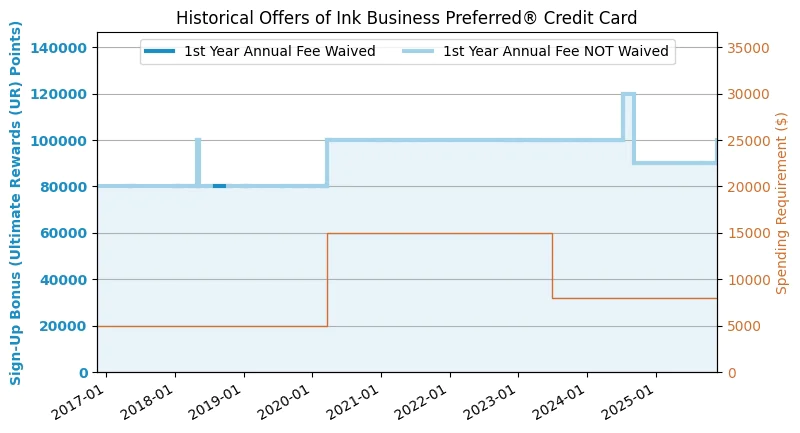

- 100k Sign-up Bonus: Earn 100,000 UR Points by spending $8,000 within 3 months of opening your account. The highest recent sign-up bonus was 120k.

- This card awards Ultimate Rewards (UR) points, which we estimate at 1.6 cents per point (see below for details). Therefore, its maximum sign-up bonus of 120k is worth approximately $1,920!

- After obtaining this card, you can convert UR points into airline miles or hotel points, similar to CSP .

- Travel, shipping, internet, telecommunications, social media advertising, and search engine spending are all worth 3 times the UR (Universal Revenue)! The cap is $150,000 in spending per year (account anniversary year, non-calendar year), meaning you can earn a maximum of $450,000 UR from these purchases in a year!

- Earn 1 UR point for every $1 spent on other purchases.

- [New] Points Boost : When making travel purchases through Chase Travel , the default points redemption value is 1.0 cent/point. However, certain airlines and hotels offer redemption values that can fluctuate higher, reaching up to 1.5 cents/point (1.75 cpp for premium cabins). This fluctuating redemption value is called "Points Boost." See " Points Boost Benefits Introduction " for a detailed explanation. This new benefit replaces the previous fixed 1.25 cpp redemption rate for UR points on Chase Travel . Given that CSR offers up to 2.0 cents/point redemption in the same way, using CSR for redemption is still more recommended.

- Excellent Purchase Protection Benefits: You can receive up to $10,000 in compensation for each theft or damage of your purchased item within 120 days.

- $600 Mobile Phone Insurance: Use this card to pay your mobile phone bill and get insurance against damage to or theft of your mobile phone. The maximum payout per incident is $600, with a deductible of $100.

- Car rental is primary coverage, provided it is for business purposes.

- This card allows you to "Refer a friend" : If you recommend this card to a friend and they successfully apply for it, you will receive 20k UR points for each successful referral, up to a maximum of 100k points per calendar year.

- No Foreign Transaction Fee (FTF)。

shortcoming

- The annual fee is $95. Online applications do not waive the first year's fee; applying in person may result in an offer to waive the first year's fee.

UR Points Introduction

- Credit cards that allow you to accumulate UR points include: Chase Freedom Student , Chase Freedom , Chase Freedom Unlimited (CFU) , Chase Sapphire Preferred (CSP) , Chase Sapphire Reserve (CSR) , Chase Ink Cash (Business Card) , Chase Ink Unlimited (Business Card) , Chase Ink Preferred (Business Card) , etc.

- The UR points accumulated from each UR card can be transferred to another UR card at any time.

- UR points never expire. Stages will cause the UR points accumulated on a card to disappear, but this can be resolved by moving the UR points to another UR card beforehand.

- If you hold a Chase Sapphire Preferred (CSP) , Chase Sapphire Reserve (CSR) , or Chase Ink Preferred (Business Card) , UR points can be converted into hotel points. One of the most cost-effective uses is a 1:1 conversion to Hyatt points . UR points can also be converted into airline miles. One of the most common and cost-effective uses is a 1:1 conversion to United Airlines (UA) miles (Star Alliance), which can then be combined with miles accumulated through your UA card to purchase a flight back to your home country. Other recommended mileage options include Southwest Airlines (WN) (non-alliance), British Airways (BA) (Oneworld), Virgin Atlantic (VS) (non-alliance), etc. Using these points in this way yields a value of approximately 1.6 cents per point.

- With a Chase Sapphire Reserve (CSR) , booking flights and hotels on Chase Travel allows you to redeem UR points at a floating rate of up to 2.0 cents/point. With a Chase Sapphire Preferred (CSP) or Chase Ink Preferred (business card) , the redemption rate is a floating rate of up to 1.5 cpp (1.75 cpp on premium cabins). See the Points Boost benefits overview for details .

- Holding any UR card allows you to exchange UR points for cash at a fixed value of 1 cent per point.

- In summary, we give UR a total valuation of approximately 1.6 cents/point.

- For more information on the UR points system, see " Maximizing the Value of Credit Card Points " (overview) and " UR Points Accumulation Methods " and " UR Points Usage " (very detailed).

Recommended application time

- [5/24 Policy] If you have five or more new credit card accounts within two years (all new accounts, not just Chase accounts), Chase will not approve the card for you, regardless of your credit score. For details on how to circumvent the 5/24 rule, please see "Chase 5/24 Rule Explained" .

You will not receive the sign-up bonus and your application will be instantly rejected if you meet any of the following conditions: (1) You currently hold this credit card; (2) You have received the sign-up bonus for this card within the past 24 months. Note that the count starts from the moment you received the sign-up bonus, not from the moment you opened the card or closed it.[Correction] This rule does not exist in the Chase Ink series!- [New] Chase has introduced the "once in a lifetime" concept : if you've ever had this card, you may not be able to receive the sign-up bonus.

- Try not to apply for more than one Chase Business card within 3 months, otherwise you will likely be rejected.

- It is recommended to apply after having a credit history of more than one year.

Summarize

This card offers very generous sign-up bonuses, and if you're under 5/24, it's highly recommended to apply. Compared to the older Ink Plus, this card loses the 5x points earning potential, and the lack of an office supplies category in the bonus category is a significant loss. As compensation, it improves the points earning potential in other categories and raises the maximum points earned from 250,000 UR to 450,000 UR. Overall, this is still a good card, but it doesn't shine as brightly as the previous Ink Plus. It's recommended for those who have significant spending in the 3x categories. If you don't plan to hold it long-term, you can downgrade to the no-annual-fee Ink Cash or Ink Unlimited.

Related credit cards

- Chase Ink Cash

- Chase Ink Unlimited

- Chase Ink Preferred (Main Text)

Best downgrade option

- Chase Ink Cash

- Chase Ink Unlimited

After applying

- To check your Chase business card application status, call 800-453-9719. This is an automated call, and the information you receive will likely be as follows: Receive decision in 2 weeks: High probability of approval; Receive decision in 7-10 days: High probability of rejection; Receive decision in 30 days: Simply indicates further review is needed, and no further information is available at this time.

- Chase reconsideration backdoor phone numbers: 888-270-2127 or 888-609-7805. Chase business card reconsideration can be difficult; be prepared to be asked various business operation details.

Application link

https://creditcards.chase.com/business-credit-cards/ink/business-preferred

Share

What was your reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

![[NM, AZ, CO, CA, ID, TX, UT, WY] AmaZing Business Credit Card Up To $1,000](https://ceacer.com/uploads/images/202511/img_w500_690af9254cd176-89582216.webp)