Citi Strata Elite: Why This Might Be the Strongest Premium Credit Card in 2025

Citi Strata Elite 2025 review covering rewards, travel credits, lounge access, ThankYou Points, portal performance, pros and cons, and real-world user experience.

Citi Strata Elite: Why It Could Be the Most Underrated Premium Card of 2025

In an era where most premium credit cards are quietly raising annual fees while trimming real-world value, the Citi Strata Elite has emerged as a surprisingly practical contender.

Rather than flashy marketing perks that require extra spending, this card delivers usable value, especially for travelers who understand how to maximize bank travel portals and flexible reward currencies.

Authoritative background on premium credit cards:

- https://www.cnbc.com/select/best-premium-credit-cards/

- https://www.nerdwallet.com/best/credit-cards/premium

Real Cost vs Advertised Cost

The published annual fee is $595, but usable credits change the real cost structure.

The card includes a $300 travel credit usable on standard hotels and flights, and a $200 flexible credit that many experienced users extract using refundable airfare techniques.

This reduces the effective out-of-pocket cost to roughly $95 per year.

- https://onemileatatime.com/guides/airline-refundable-tickets-credit-cards/

- https://thepointsguy.com/credit-cards/using-travel-credits/

Hotel and Travel Portal Performance

Unlike many competitors, Citi does not force users into luxury-only hotel programs.

The Citi travel portal is powered by Agoda, part of Booking Holdings.

- https://www.agoda.com/info/

- https://www.hilton.com/en/hilton-honors/terms/

- https://all.accor.com/loyalty-program/terms.shtml

Points System and Earning Rates

Citi Strata Elite earns Citi ThankYou Points, which are transferable to airline and hotel partners.

- https://www.citi.com/credit-cards/thankyou-points

- https://awardwallet.com/blog/citi-thankyou-transfer-partners/

Core earning structure:

- 12X points on travel booked via Citi portal

- 6X on flights booked through portal

- 6X dining on Friday and Saturday evenings

- 3X dining other days

- 1.5X on all other spending

Airport Lounge Access

The card provides Priority Pass membership for the cardholder and two guests.

It also includes four American Airlines Admirals Club passes per year.

Travel Protections

Benefits include trip delay coverage, trip cancellation/interruption insurance, and Global Entry or TSA PreCheck credit.

- https://www.cbp.gov/travel/trusted-traveler-programs/global-entry

- https://thepointsguy.com/guide/primary-rental-car-insurance/

Real-World Portal Behavior

Experienced users have reported:

- Some non-refundable hotels being refunded through the portal interface

- Some flights refundable beyond DOT minimums

- Occasional transfer glitches where points were not deducted

Who This Card Is Best For

This card works best for:

- Frequent travelers

- Lounge users

- Citi ecosystem users

- People comfortable with travel portals

It is not designed for beginners.

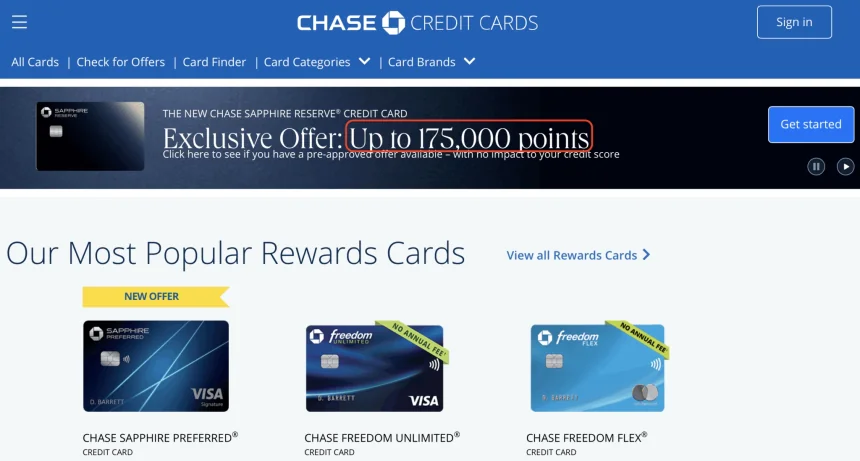

Welcome Bonus Ranges

Public offers usually range between 75,000 and 100,000 ThankYou Points.

Final Verdict

Citi Strata Elite does not rely on gimmicky credits or confusing monthly coupons.

It delivers predictable, flexible value in a market full of watered-down premium cards.

For experienced users, it quietly becomes one of the strongest premium cards available in 2025.

![[Expired] Target: Buy $100 Apple Giftcard & Get Bonus $10 Target Giftcard (4/13-4/19)](https://ceacer.com/uploads/images/202512/img_w860_692e2f890d8a52-16791490.webp)

![[Expired] Pepper: Save On Southwest, Uber, Chipotle, Giant Eagle & More (Stack With Amex Offer)](https://ceacer.com/uploads/images/202512/img_w860_692e0d9036f018-13021831.webp)

The insurance is a bit too weak; there's no cellphone protection, and the rental car is only secondary. I don't know how they can be a benchmark for World Legend. :yaoming:

I also discovered this when I booked a hotel using Citi Travel last time; I got a lower price than the hotel's official website member rate.