Citibank Strata Elite Credit Card — Updated November 2025: Earn a 100,000-Point Bonus

The Citibank Strata Elite Credit Card continues to stand out in November 2025 with a boosted 100,000-point welcome bonus, premium travel perks, strong earning categories, and flexible redemption options. It remains a top choice for travelers and cardholders looking for high-value rewards and everyday benefits.

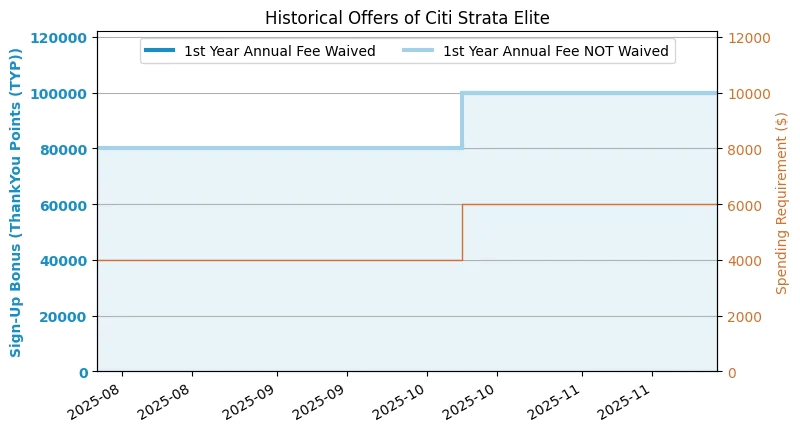

The online application link for this card has reached 100k, the highest number ever!

Application link

feature

- 100k Sign-up Bonus: Earn 100,000 Thank You Points (TYP) by spending $6,000 within the first 3 months of opening the account. This is the highest sign-up bonus for this card.

- This card awards Thank You Points (TYP), which we value at 1.6 cents per point (see below for details). Therefore, its maximum sign-up bonus of 100k points is worth approximately $1,600!

- With this card, you can convert your TYP points into airline miles. Additionally, you can exchange TYP points for cash at a fixed rate of 1 cent per point.

- Point accumulation structure:

- Earn 12x TYP cashback when booking hotels, car rentals, and attractions through CitiTravel: Hotels, Car Rentals, Attractions;

- Get 6x TYP cashback when you book flights with CitiTravel;

- Earn 6x TYP points when dining during the "Citi Nights" period (defined as 6 PM – 6 AM ET every Friday and Saturday);

- Earn 3x TYP points when dining at other times;

- All other purchases will receive a 1.5x rebate.

- $300 Hotel Reimbursement: You can get up to $300 reimbursement for hotel bookings made through Citi Travel every year (Calendar Year), with a minimum of 2 nights required.

- $200 Splurge Credit: Earn up to $200 annually (Calendar Year) at select partner merchants (maximum 2). Current partner merchants include: 1stDibs , American Airlines (exclusions apply), Best Buy , Future Personal Training , and Live Nation (exclusions apply). More may be added later. The terms seem to apply to gift card purchases at AA and Best Buy, but further data is needed to support this.

- $200 Blacklane Credit: $100 reimbursement every six months. Blacklane is an airport limousine service.

- Four AA Admirals Club vouchers are given out every calendar year.

- Cardholders will receive a separate Priority Pass Select (PPS) card, usable in many lounges worldwide (including China), such as the first-class lounges of airlines like Air China in Beijing. Two guests can accompany the cardholder free of charge.

- No Foreign Transaction Fee (FTF)。

shortcoming

- The annual fee is $595, and the first year's fee is not waived. Citigold members (requires $200k in assets) can reduce the annual fee by $145 to $450. [Friendly Reminder] Annual fees for all credit cards are not included in sign-up spending targets!

TYP Points Introduction

- Credit cards that allow you to accumulate TYP include: Citi Strata Elite , Citi Strata Premier , Citi Strata , Citi Custom Cash , Citi Double Cash , etc.

- TYP earned from different cards can be added to the same thankyou.com account, and points that are about to expire will be used automatically first.

- Points generally never expire, but completing levels, transferring cards, or receiving points from others may cause the TYP on your account to expire for a period of time.

- If you hold a Citi Strata Premier , Citi Strata Elite , or Citi Prestige (discontinued) , TYPs can be converted into airline miles. The most cost-effective use of TYPs is a 1:1 conversion to American Airlines (AA) miles (Oneworld) or EVA Air (BR) miles (Star Alliance). Other recommended mileage options include: Cathay Pacific (CX) miles (Oneworld), Avianca (AV) miles (Star Alliance), Singapore Airlines (SQ) miles (Star Alliance), Air France-KLM Flying Blue miles (SkyTeam), Virgin Atlantic (VS) miles (non-alliance), etc. Using TYPs this way yields a value of approximately 1.6 cents per point.

- TYP can be exchanged for money at a fixed value of 1 cent/point.

- If you hold a Citi Prestige (now discontinued) , you can book flights directly on thankyou.com at a fixed value of 1.25 cents/point . This is one of the common uses of TYP. When buying flights/hotels with TYP, you can use a combination of points and cash, meaning if you don't have enough points, you can pay the rest using other methods.

- In summary, our overall valuation for TYP is approximately 1.6 cents/point.

- For more information on the TYP points system, please see " Maximizing the Value of Credit Card Points " (Overview) and " TYP Point Accumulation Methods " and " TYP Point Usage " (Very Detailed).

Recommended application time

- 【1/48 Rule】If you have received the sign-up bonus for this card within the past 48 months, or if you have transferred other cards that have received sign-up bonuses to this card within the past 48 months, you will not be eligible for the new sign-up bonus.

- [8/65 Rule] Citi allows a maximum of one card application within 8 days and a maximum of two card applications within 65 days, regardless of whether the application is approved.

- Citi places more emphasis on recent hard pulls and recommends applying when the number of hard pulls in the past 6 months is less than 3 (Citi usually requires less than 6, but this card is an exception), although this is not a strict rule.

- It is recommended to apply only if you have a credit history of more than one year.

Summarize

This card isn't very attractive. The annual fee is a whopping $595, and the initial limited-time offer sign-up bonus is only 80k, which is really underwhelming. The reimbursements are relatively easy to obtain, at least not those annoyingly monthly payments. However, even assuming you can get $300 in hotel reimbursements plus $200 in Splurge reimbursements when buying AA Gift Cards, it still doesn't offset the annual fee. Unless you're very willing to use CitiTravel for various travel bookings, it's hard to justify the high annual fee.

To effectively utilize Citi TYP points for point transfers, simply holding the $95 annual fee Citi Strata Premier is sufficient; this premium card is unnecessary.

Related credit cards

- Citi Strata

- Read the Premier Strata

- Citi Strata Elite (This article)

Best downgrade option

- Citi Strata . The reason for recommending switching to a TYP card is that TYP points won't expire after the switch. If you switch to a DC/Custom Cash card, note that previously accumulated TYP points will expire within 60 days.

After applying

- To check your application status, you can call Citi at 888-201-4523.

- Citi reconsideration backdoor phone number: 605-331-1698. This is a number commonly referred to as the Citi EO (Executive Office), and it's not intended for reconsidering credit card applications, but it's very useful.

Sign-up Rewards Trend Chart