Bank of America Customized Cash Rewards Card Review: Earn 6% Cash Back in Your Favorite Category (Up to 8.25% With Preferred Rewards)

The Bank of America Customized Cash Rewards Credit Card offers flexible earning potential with its popular “3-2-1” cash back structure—and a new limited-time offer makes it even better. During your first year, you can earn up to 6% cash back in your chosen bonus category, which includes options like gas, online shopping, dining, travel, drugstores, or home improvement.

The Bank of America Customized Cash Rewards Credit Card offers flexible earning potential with its popular “3-2-1” cash back structure—and a new limited-time offer makes it even better. During your first year, you can earn up to 6% cash back in your chosen bonus category, which includes options like gas, online shopping, dining, travel, drugstores, or home improvement.

If you’re a Preferred Rewards member, your bonus multiplier increases your total cash back by 25% to 75%, boosting your return to as high as 8.25% in select categories. With no annual fee, this card is a strong pick for anyone who wants a personalized rewards strategy without paying extra for it.

In addition to the category bonus, you’ll earn 2% cash back at grocery stores and wholesale clubs, and 1% cash back on all other purchases. Cardholders can also take advantage of introductory APR offers and online account management through Bank of America’s robust digital banking platform.

Overall, the Bank of America Customized Cash Rewards Card stands out for its flexibility, competitive earning potential, and the ability to supercharge your rewards with the Preferred Rewards program. Whether you spend more on travel, gas, or online shopping, this card lets you earn more where it matters most.

- New customers: $200 cash rewards bonus after $1,000 in purchases in the first 90 days.

- Earn 1% cash back on every purchase, 2% at grocery stores and wholesale clubs, and 3% on your choice category up to the first $2,500 in combined grocery/wholesale club/choice category purchases each quarter. During the first year, you’ll get an extra 3% cash back on the choice category.

- Cardholders will be able to choose their 3% cash back category from one of these 6 options: gas and EV charging stations; online shopping, including cable, internet, phone plans and streaming; dining; travel; drug stores and pharmacies; or home improvement and furnishings.. You can change your category once each calendar month in-app or online. Do nothing and it will stay the same.

- Bank of America Preferred Rewards® members earn 25%-75% more cash back on every purchase. However, Preferred Rewards bonuses are not applied to the 3% first-year bonus. Details below.

- 0% Introductory APR offer. See link for details.

- No annual fee.

During the current limited-time offer, the cash back rewards on your special choice category are boosted by an additional 3% for the first year. The 75% Preferred Rewards bonus for Platinum members does not apply to the extra 3%, so the net cash back during the first year for Platinum members would be 3% * 1.75 + 3% = 8.25% cash back on your Choice Category during the first year, subject to the $2,500 cap per quarter which includes grocery/wholesale club purchases. You would also get 3.5% cash back on your grocery/wholesale club purchases during the first year, again subject to the $2,500 cap per quarter which includes any purchases in your Choice Category.

Theoretically, if you only used your card for the Choice Category and spent exactly $2,500 in that Choice Category per quarter, in one year you would rack up $825 in rewards from $10,000 in purchases. This would be separate from the one-time $200 new customer cash bonus.

Personally, I think the “Online Shopping” category is the most flexible. Per this page: “Online Shopping category includes purchases made online via a website or a digital application (an app). Here are the provided examples of eligible merchants: Amazon, Walmart, Comcast, Etsy, Netflix, Nordstrom, Ticketmaster.

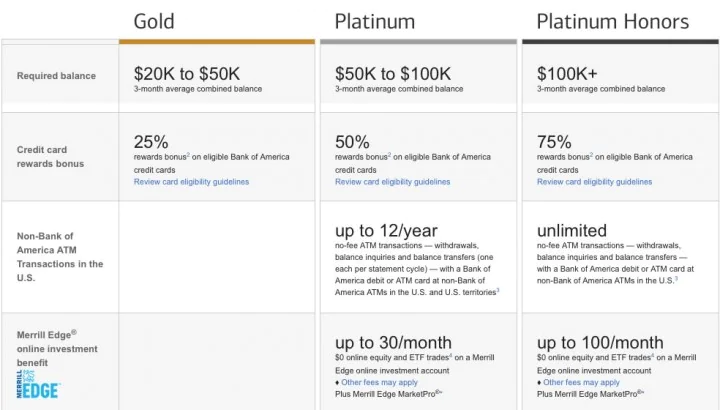

Preferred Rewards bonus basics. The Preferred Rewards program is designed to rewards clients with multiple account and higher assets located at Bank of America banking, Merrill Edge online brokerage, and Merrill Lynch investment accounts. Here is a partial table taken from their comparison chart (click to enlarge):

Let’s consider the options. Bank of America’s interest rates on cash accounts tend to be lower than highest-available outside banks (read: nearly zero), so moving cash over to qualify may result in earning less interest on your cash deposits. Merrill Lynch advisory accounts also usually come with management fees. The sweet spot is therefore the Merrill Edge self-directed brokerage, where you can move over your existing brokerage assets like stocks, mutual funds, and ETFs held elsewhere (Vanguard, Fidelity, Schwab, etc).

In the past, moving over to Merrill Edge at the Platinum and Platinum Plus levels also led to 30 to 100 free online stock trades every month. Fast forward to now, and nearly all major online brokers offer commission-free trades anyway.

Personally, I moved over $100k of brokerage assets from Vanguard to Merrill Edge to qualify for Platinum Honors. You should ask Merrill Edge if they will cover any ACAT transfer fees involved. I realize not everyone will have this level of assets to move around, but if you do then it is worth considering. Keep in mind that it will take a while for your “3-month average combined balance” to reach the $100k level and officially qualify for Platinum Honors. You might become Gold first, then Platinum, and so on. After that, the 25%-75% rewards bonus on credit card rewards kick in. Once you reach a certain tier, BofA guarantees that you will stay there for a year no matter what, even if your balance fluctuates. (In certain cases, when you open a new Merrill Edge account and new BofA Checking with a asset transfer bonus offer, you may be eligible to “fast track” to a higher tier.)

Cash Back Rewards after Preferred Rewards bonus (standard):

Recall that the basic structure is “1/2/3”; you get 1% cash back on every purchase, 2% at grocery stores and wholesale clubs and 3% on choice category for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter (1/2/3). Here’s how the bonuses work out:

- Platinum Honors: 1.75% cash back on every purchase, 3.5% at grocery stores and wholesale clubs, and 5.25% on choice category for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter.

- Platinum: 1.5% cash back on every purchase, 3% at grocery stores and wholesale clubs, and 4.5% on choice category for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter.

- Gold: 1.25% cash back on every purchase, 2.5% at grocery stores and wholesale clubs, and 3.75% on choice category for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter.

In the past, moving over to Merrill Edge at the Platinum and Platinum Plus levels also led to 30 to 100 free online stock trades every month. Fast forward to now, and nearly all major online brokers offer commission-free trades anyway.

Personally, I moved over $100k of brokerage assets from Vanguard to Merrill Edge to qualify for Platinum Honors. You should ask Merrill Edge if they will cover any ACAT transfer fees involved. I realize not everyone will have this level of assets to move around, but if you do then it is worth considering. Keep in mind that it will take a while for your “3-month average combined balance” to reach the $100k level and officially qualify for Platinum Honors. You might become Gold first, then Platinum, and so on. After that, the 25%-75% rewards bonus on credit card rewards kick in. Once you reach a certain tier, BofA guarantees that you will stay there for a year no matter what, even if your balance fluctuates. (In certain cases, when you open a new Merrill Edge account and new BofA Checking with a asset transfer bonus offer, you may be eligible to “fast track” to a higher tier.)

Cash Back Rewards after Preferred Rewards bonus (standard):

Recall that the basic structure is “1/2/3”; you get 1% cash back on every purchase, 2% at grocery stores and wholesale clubs and 3% on choice category for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter (1/2/3). Here’s how the bonuses work out:

- Platinum Honors: 1.75% cash back on every purchase, 3.5% at grocery stores and wholesale clubs, and 5.25% on choice category for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter.

- Platinum: 1.5% cash back on every purchase, 3% at grocery stores and wholesale clubs, and 4.5% on choice category for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter.

- Gold: 1.25% cash back on every purchase, 2.5% at grocery stores and wholesale clubs, and 3.75% on choice category for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter.

![Chase Aeroplan Credit Card: Earn Up to 100k Miles + Extra 0.5x Rewards [Nov 2025 Update]](https://ceacer.com/uploads/images/202511/img_w860_69262e2d39e983-91435062.webp)