Chase Aeroplan Credit Card: Earn Up to 100k Miles + Extra 0.5x Rewards [Nov 2025 Update]

Maximize your travel rewards with the Chase Aeroplan (AC) Credit Card. As of November 2025, new cardholders can earn 75,000 miles after spending requirements, an additional 25,000 miles, plus an extra 0.5x miles on purchases. Discover how to take full advantage of these offers and start planning your next trip with bonus rewards.

![Chase Aeroplan Credit Card: Earn Up to 100k Miles + Extra 0.5x Rewards [Nov 2025 Update]](https://ceacer.com/uploads/images/202511/img_w860_69262e2d39e983-91435062.webp)

[Updated 2025.11] The new sign-up bonus, in addition to the 75k+25k offer, includes an extra 0.5x points earned up to 20k points before January 15, 2026. This is suitable for those who already plan to use this card extensively.

Application link

feature

- 75k + 25k Sign-up Bonus: Earn 75,000 Aeroplan points for spending $4,000 within the first 3 months of opening the account; earn an additional 25,000 AC points for spending a total of $20,000 within the first 12 months of opening the account, for a total of 100k points.

- The AC miles earned with this card are worth approximately 1.4 cents per mile ( estimated airline mileage ), so the 75k sign-up bonus is worth about $1,050. For details on how to use AC miles, please refer to the " AC Mileage Redemption Guide ".

- Earn 3x Air Canada miles on purchases at Air Canada stores, supermarkets, and restaurants, and 1x miles on other purchases.

- For every $2,000 spent each calendar month, you will receive 500 bonus points, up to a maximum of 1,500 points per month.

- 【New】 “Pay Yourself Back”: AC points can be redeemed for statement credit at a fixed rate of 1.25 c/p to offset travel-related expenses. Previously there was no limit, but starting in 2025, the annual limit will be 200k points (see this article for details ).

- 【New】 10% Transfer Bonus: With this card, if you transfer 50k or more points in a single transaction, you will receive a 10% bonus when transferring points from Chase UR points to AC miles (originally 1:1, but with the bonus it becomes 1:1.1). This bonus can be stacked with regular transfer bonus promotions. The maximum is 25,000 bonus points per calendar year.

- Upon activation, you will receive Aeroplan 25K membership, valid until the end of the following year. You can maintain your membership by spending 15k per calendar year. Note: Starting February 1, 2026, AC 25K members will also receive an extra checked baggage allowance on UA and Lufthansa Group flights.

- [2025 is the last year] Spending $50k each calendar year can upgrade your AC membership by one level.

- [New] Starting in 2026, you will receive 5,000 SQCs annually. Spending $25,000 will earn you 10,000 SQCs, spending $50,000 will earn you another 10,000 SQCs, and spending $75,000 will earn you Air Canada AC 35K membership. Note that SQCs are for upgrading to higher Air Canada membership levels and are not redeemable for Aeroplan miles.

- Cardholders and up to eight accompanying persons can check one piece of luggage free of charge when traveling on AC flights.

- With this card, Air Canada miles will not expire (otherwise they will expire after 18 months without any promotions); if your miles have accidentally expired, you can revive them by applying for a new Air Canada card within 6 months .

- This card can reimburse the application fees for Global Entry , TSA Pre✓ ($85), or NEXUS ($50), up to $100 every 4 years. Global Entry is a fast track at U.S. Customs and Border Protection, and TSA Pre✓ is a fast track at domestic airports in the United States; only U.S. citizens or green card holders can apply for them.

- No Foreign Transaction Fee (FTF)。

shortcoming

- The annual fee is $95, and the first year's fee is not waived.

Recommended application time

- [5/24 Policy] If you have five or more new credit card accounts within two years (all new accounts, not just Chase accounts), Chase will not approve the card for you, regardless of your credit score. For details on how to circumvent the 5/24 rule, please see "Chase 5/24 Rule Explained" .

- You will not receive the sign-up bonus and your application will be instantly rejected if you meet any of the following conditions: (1) You currently hold this credit card; (2) You have received the sign-up bonus for this card within the past 24 months. Note that the count starts from the moment you received the sign-up bonus, not from the moment you opened the card or closed it.

- Try not to apply for more than two Chase cards within 30 days, otherwise you will likely be rejected.

- It is recommended to apply after having a credit history of more than one year.

Summarize

Those who want AC miles can consider applying. If you were previously on the waitlist, remember to wait for the link to come out before applying, since the rewards are slightly more generous.

This card offers 50k points, which can be topped up yourself but not refunded for amounts below 50k. This means it's only valid for redemptions of 50k points or more, making it less flexible than directly offering 100k points. This is a clever trick by AC and Chase. It's possible that offers directly giving points will appear in the future.

AC miles can be easily earned through Chase Ultimate Rewards , Amex Membership Rewards , and Capital One Miles , so you should be able to accumulate a significant number of AC points even without applying for this card. However, if you have a clear plan to use AC miles and meet the 50k point requirement per card, then this card is worth considering.

Another highlight worth considering is the free AC 25k membership, which grants you nearly two years of membership upon card activation, and you can maintain that membership by spending $15k annually thereafter. If you think the AC 25k membership will be useful, then this card is worth considering.

There is also an article on this site titled "Some Little-Known Benefits of the Chase Air Canada Aeroplan Credit Card ," which those interested in this card may want to read.

After applying

- To check your Chase application status, you can call 800-436-7927. This is an automated call, and the information you receive will likely be as follows: Receive decision in 2 weeks: The chances of approval are relatively high; Receive decision in 7-10 days: The chances of rejection are relatively high; Receive decision in 30 days: This simply indicates that further review is needed, and there is no further information available at this time.

- Chase reconsideration backdoor phone numbers: 888-270-2127 or 888-609-7805. If your Chase card application isn't approved instantly, you can prepare to call these numbers. Customer service will directly ask for your personal information and then proceed with the review; they rarely ask questions, just listen to the music… After the music plays, customer service will give you a decision, often just an approval or rejection. They may also ask for supplementary materials; just listen carefully to the requirements and bring the corresponding documents to a branch or fax them online.

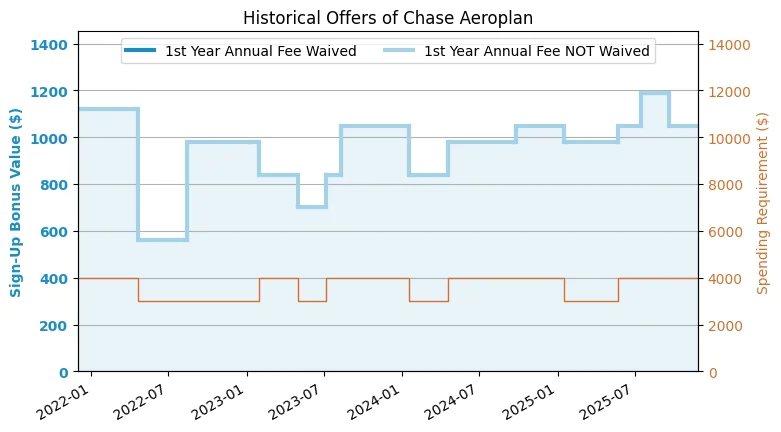

Sign-up Rewards Trend Chart