Capital One to Manage Discover Cards: What You Need to Know [November 2025 Update]

In a major shift, Capital One will take over the management of Discover credit cards starting January 2026. Get the latest details on how this change will affect your account and what to expect from the new system, as Capital One streamlines your card management through their app and website.

![Capital One to Manage Discover Cards: What You Need to Know [November 2025 Update]](https://ceacer.com/uploads/images/202511/img_w860_692382a1e0d568-99330274.webp)

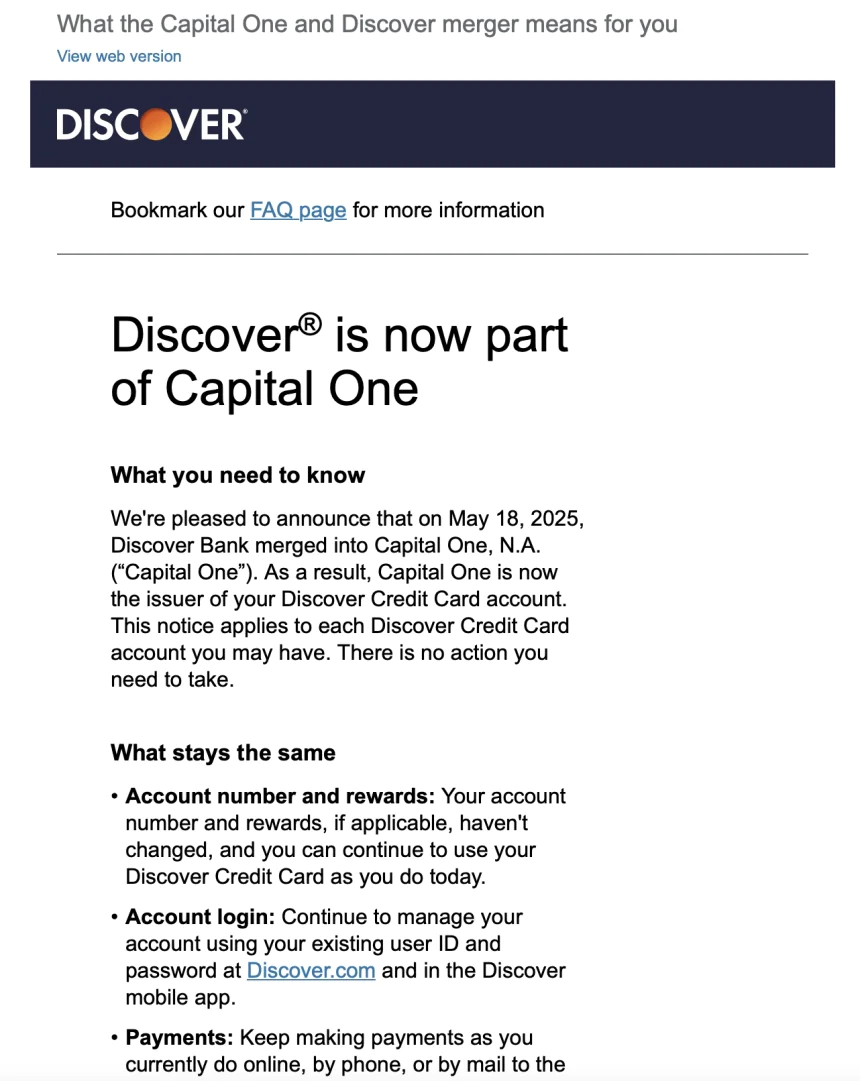

Discover cardholders have begun receiving emails stating that starting January 26, 2026, their Discover cards will be managed via Capital One's website/app. The merger is progressing further.

The email also confirmed that the card number and card benefits would remain unchanged.

1HT: Reddit.

On May 18, 2025, Discover and Capital One officially merged. The official merger website link is here . Discover cardholders should have received an email today informing them of this.

There haven't been any substantial changes yet, but various operational details will be gradually modified in the future.

The latest development is that Capital One's acquisition of Discover has received approval from the Delaware State Bank Commissioner. (HT: DoC & Capital One website ). The reason for choosing Delaware is because Discover is a Delaware-chartered bank. This is an important step, but certainly not the final one. There will be several legal challenges: approval from shareholders of both Capital One and Discover, as well as approval from the Board of Governors of the Federal Reserve System and the Office of the Comptroller of the Currency. Capital One itself expects the acquisition to be completed as early as 2025.

[Original text from February 2024]

Big news broke at the very beginning of the 2024 Lunar New Year. On February 19th, major news outlets reported (please refer to reports from the WSJ , Reuters , and Bloomberg ) that Capital One planned to acquire Discover in an all-stock deal worth $35.3 billion. If the acquisition passes antitrust review, the combined bank will become the sixth largest bank in the United States (ranked by assets).

Unsurprisingly, Discover is often the first official credit card with real benefits for many newcomers to the US, perhaps aside from other credit-building tools like BoA's secured credit cards. Its flagship card, Discover IT, is relatively easy to obtain, has no annual fee, and offers a useful 5% cashback every quarter, making it very popular. Since it has no annual fee, many people will likely keep it. Discover is more than just a commercial bank; its payment network covers over 200 countries and regions, although its coverage is far less than the other three major players: Visa, MasterCard, and American Express. Capital One is currently the fourth-largest credit card issuer in the US, and Discover is the sixth, making this acquisition a significant undertaking.

Let's take a look at the general details of the acquisition plan. According to the currently announced plan, Capital One will pay Discover's existing shareholders in an all-stock transaction at a ratio of 1:1.0192, meaning each Discover shareholder will receive 1.0192 Capital One shares. Based on last Friday's (February 16th) closing price, this acquisition plan represents a premium of 26.6%. Upon completion of the transaction, Capital One's existing shareholders will hold 60% of the new company's shares, while Discover's existing shareholders will hold the remaining 40%.

Of course, such a large-scale acquisition will inevitably require a lengthy antitrust investigation before it can be finalized. As a credit card blog, the changes we are most concerned about, such as sign-up bonuses and the approval process, may not be answered for several years. Hopefully, the two banks can each take the best aspects, rather than the worst. For example, instead of having to go through all that trouble to get a card that was previously available even with zero credit history, you'll now have to go through three different banks!