Mortgage Rates Today: Why the 30-Year Fixed Stays Near 6.3% in November 2025

Mortgage rates today are holding around 6.24% to 6.30% as the U.S. housing market stabilizes. Learn what’s driving today’s mortgage rates, how buyers should react, and whether waiting or locking now makes more financial sense.

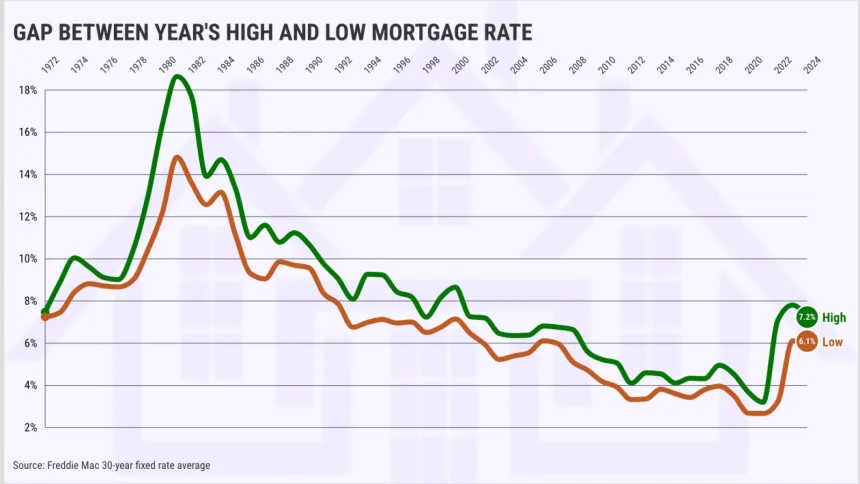

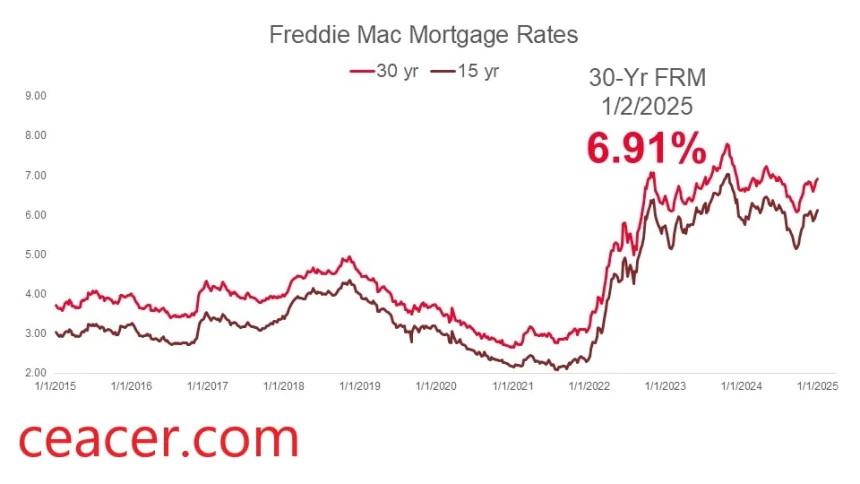

Mortgage rates today are sitting in a narrow but important range as we head deeper into November 2025. The average 30-year fixed mortgage rate is hovering around 6.24% to 6.30%, according to national lender surveys and recent market data. While this isn’t the ultra-low era many homeowners remember from several years ago, it’s also far from the high-volatility spikes that made headlines in 2023 and early 2024.

This steadier rate environment is giving buyers and refinancers a rare moment to catch their breath. Yet it also raises a familiar question: Should you lock your mortgage rate today, or wait for a better opportunity?

What’s pushing mortgage rates where they are today?

To understand why mortgage rates today look the way they do, it helps to look beneath the surface of a few major market forces.

Treasury yields remain the compass. Mortgage lenders rely heavily on the 10-year Treasury as a benchmark. With yields sitting slightly above the 4% line, lenders are keeping mortgage pricing conservative. A shift in bond demand or an unexpected inflation report can easily nudge rates in either direction.

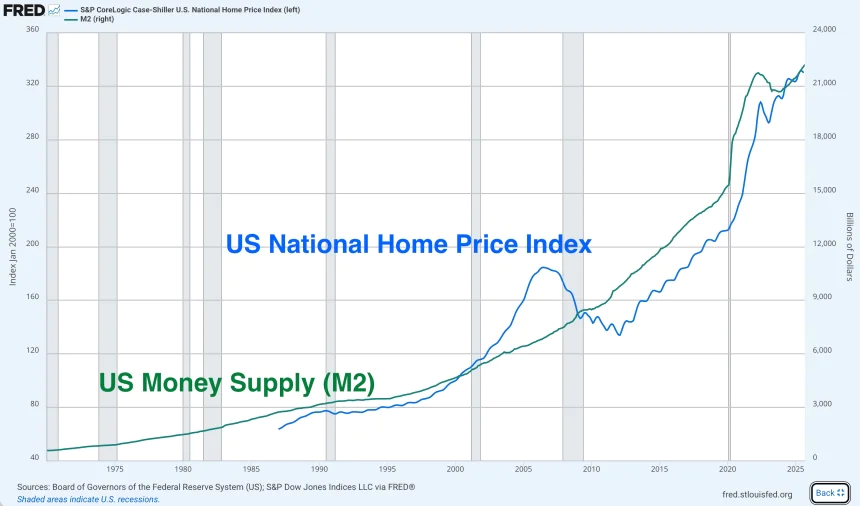

Inflation is cooling, but not cold. While the Federal Reserve has paused rate hikes, inflation still sits above its comfort zone. That uncertainty keeps lenders from dropping mortgage rates too aggressively. When the cost of money is unpredictable, lenders price in safety.

Home inventory remains tight. Fewer sellers are listing their homes, and that puts pressure on the buying cycle. Lenders compensate by setting rates where they feel confident about long-term risk, especially for 30-year loans.

Refinancing volume is muted. Since so many homeowners locked historically low rates, refinance applications are still at a slow crawl. That leaves lenders depending on purchase borrowers, which stabilizes rates but makes large drops less likely.

What this means if you're buying a home

If you're looking at mortgage rates today because you’re planning to buy, your timing matters — but not as much as your preparation. Rates have shown less wild movement in recent months, which means the decision often comes down to your financial readiness rather than rate speculation.

A well-prepared buyer can still secure rates below the national average by tightening up their credit profile, increasing the down payment, or choosing a shorter term like a 15-year fixed, which is currently averaging closer to the mid-5% range.

What if you’re considering a refinance?

Refinancing only makes sense if your current rate is significantly higher than the best mortgage rates today. Many experts suggest a 0.5% to 1% improvement is the threshold where refinancing starts to pay off after closing costs.

However, timing is tricky. If rates dip into the low-6% or high-5% range, the window for refinancing could open for more homeowners. The challenge is that dips tend to be brief, so having your documents ready is critical.

Should you lock your rate today?

Locking a rate today gives you stability in a market that looks steady — but not settled. Mortgage analysts don’t expect dramatic declines this year unless inflation falls faster than anticipated or Treasury yields drop sharply. In other words, hoping for a sudden return to 4% rates isn’t realistic right now.

Think of locking a mortgage rate like boarding a train. Waiting for the “perfect” moment often means the train pulls away without you. If today’s rate fits your budget and aligns with your long-term plans, locking can remove a significant source of anxiety.

How to get a better rate even on the same day

One of the quirks of mortgage rates today is that you can often get very different quotes depending on which lender you call. On any given day, the spread between the highest and lowest lender quotes can be as wide as 0.4% to 0.6% — enough to change your monthly payment by hundreds of dollars.

Borrowers improve their odds by comparing at least three lenders, checking local credit unions, and using pre-approval letters as bargaining tools.

The bottom line on mortgage rates today

The rate environment for November 2025 isn’t dramatic, but it is meaningful. With the 30-year fixed at roughly 6.3%, this is a period of cautious calm. There’s potential for slight improvement, but there’s also a chance of smaller upward bumps if inflation or Treasury yields shift.

For buyers, the smart move is preparation and comparison. For refinancers, the key is calculating whether today’s mortgage rates actually lower your long-term cost. And for anyone sitting on the fence, the next few weeks could be a window where rates stay predictable — a rarity in the mortgage world.

The best decisions usually come down to readiness, clarity, and realism, rather than chasing the rate that everyone wishes would return.

Share

What was your reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0