Bank of America Mortgage Rates in November 2025: What Homebuyers Should Know

Explore the latest Bank of America mortgage rates including 30-year fixed, 15-year fixed and refinance options. Understand how rates are determined and what to look out for.

If you’re in the market for a home loan, refinancing, or just comparing lenders, it’s crucial to understand the current offering from Bank of America, a major player in the U.S. mortgage market. Below, we walk through their posted rates as of November 2025, how they compare with the broader market, what factors influence them, and what borrowers should keep in mind.

Current Bank of America Mortgage Rates

According to Bank of America’s publicly posted data:

-

A 30-year fixed mortgage rate is shown at 6.250% with an APR of 6.474% (based on a $200,000 loan, ZIP 95464) for purchase. Bank of America+2Bank of America

-

A 15-year fixed mortgage rate is listed at 5.375% with an APR of 5.760% under the same loan assumptions. Bank of America

-

For refinancing, Bank of America shows a 30-year fixed refinance rate at 6.375%, with APR around 6.561%. Bank of America

-

Adjustable-rate mortgage (ARM) options, such as the 10-year fixed/6-month ARM (10y/6m), are shown at 5.875% for the rate. Bank of America

These figures reflect what Bank of America lists under “competitive mortgage rates” for borrowers with strong credit (e.g., FICO 740+), assuming typical fees and based on a defined regional ZIP code. Bank of America

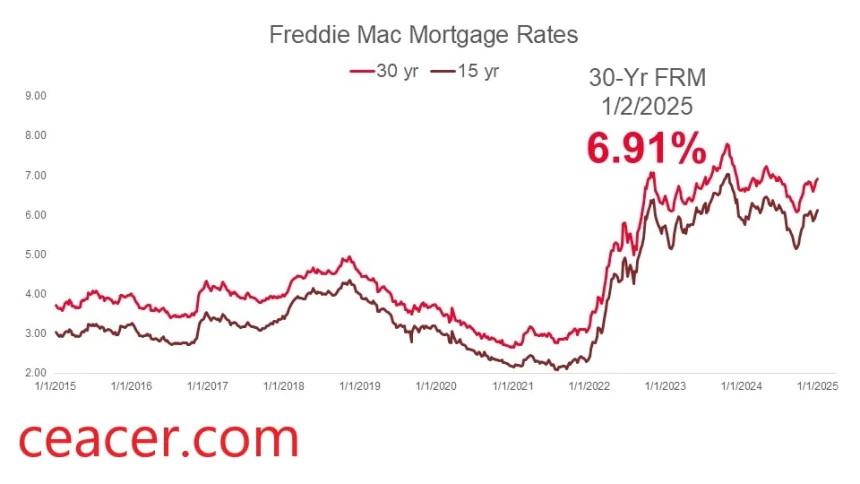

How These Rates Compare to the Broader Market

The national average for 30-year fixed mortgages hovers around 6.2%–6.4% in late 2025. For example, Bankrate reports an average of 6.29% for the week. Bankrate

In that light, Bank of America’s 6.25% base rate is regionally competitive, though remember the advertised rate might not reflect individual credit, down payment, property value, or closing cost variables.

What Influences Bank of America’s Mortgage Rates

Several key factors come into play:

-

Bond market yields, especially the 10-year U.S. Treasury, act as benchmarks for fixed mortgage rates. As yields go up, so tend mortgage rates.

-

Creditworthiness and loan profile: Borrowers with higher credit scores, sizable down payments, low debt-to-income ratios often secure the best “headline” rates. Bank of America’s published rates assume excellent credit. Bank of America

-

Loan size, property type, location and occupancy: Jumbo loans, investment properties or non-owner-occupied homes typically carry higher rates.

-

Refinancing vs purchase: Rates for refinances may differ from purchase rates, due to differing risk profiles and underlying economic conditions.

-

Fees, points and origination costs: The APR (annual percentage rate) provided by Bank of America incorporates many of these additional costs. Comparing rate alone is insufficient.

What Borrowers Should Ask or Consider

-

If you’re buying a home, lock in the rate if you anticipate rates rising, but also make sure you understand the all-in cost (rate + points + fees).

-

If you’re refinancing, look beyond the rate—does the monthly payment drop significantly? What’s the break-even period for recouping closing costs?

-

If choosing an ARM (adjustable-rate mortgage), such as the 10/6 ARM offered by Bank of America, understand the reset risk: after the fixed period ends, your rate (and payment) may increase.

-

Review the APR as listed by Bank of America. A low interest rate can hide higher fees or points.

-

Compare Bank of America’s offering with other lenders to ensure good value. Sometimes smaller lenders or online-only lenders may offer promotional rates, though trade-offs (service, flexibility) apply.

Outlook & Strategic Thoughts

Given current macroeconomic projections, including persistent inflation and moderate economic growth, many analysts expect mortgage rates to remain in the 6% region through the foreseeable future. While a significant drop below 6% seems unlikely in the short term, small moves up or down are possible.

In this environment, a rate like Bank of America’s 6.25% becomes more attractive—but the decision still hinges on your personal timeframe (how long you plan to stay in the property), financial goals and risk tolerance.

Final Word

For borrowers considering a loan from Bank of America now: the publicly posted 30-year fixed rate of approximately 6.25% places the bank in a competitive spot relative to national averages. But as with any major financial decision, the devil is in the details — credit profile, costs, timeframe, and loan features matter heavily.

To move forward confidently: gather quotes, compare APRs, ask about points and fees, and understand your “what if” scenario (e.g., if rates rise, if you sell or refinance early). With that groundwork, you can decide whether locking in now with Bank of America makes sense for you.

Share

What was your reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0