Rate Home Loans: How Today’s Lending Landscape Shapes Your Best Mortgage Decision

Understanding rate home loans has become essential for borrowers navigating today’s changing housing market. This guide breaks down current lending trends, key factors that influence loan rates, and practical steps to secure the most favorable mortgage option available today.

The housing market in the United States has been anything but predictable. Homebuyers and refinancers watch mortgage charts the way traders watch stock tickers, hoping for a moment when rates dip low enough to make a long-term commitment feel worthwhile. That’s why understanding rate home loans—how they move, why they move, and how to choose the best option—has become an essential skill rather than a technical hobby.

Even if the big economic forces that shape rates feel distant, their effects show up in a very personal way: the price of owning a home. When you’re planning for a 30-year financial decision, a small shift in rates can be the difference between comfortable monthly payments and a budget that never breathes. Learning how rate home loans work is a form of protection against uncertainty.

Why Rate Home Loans Change Constantly

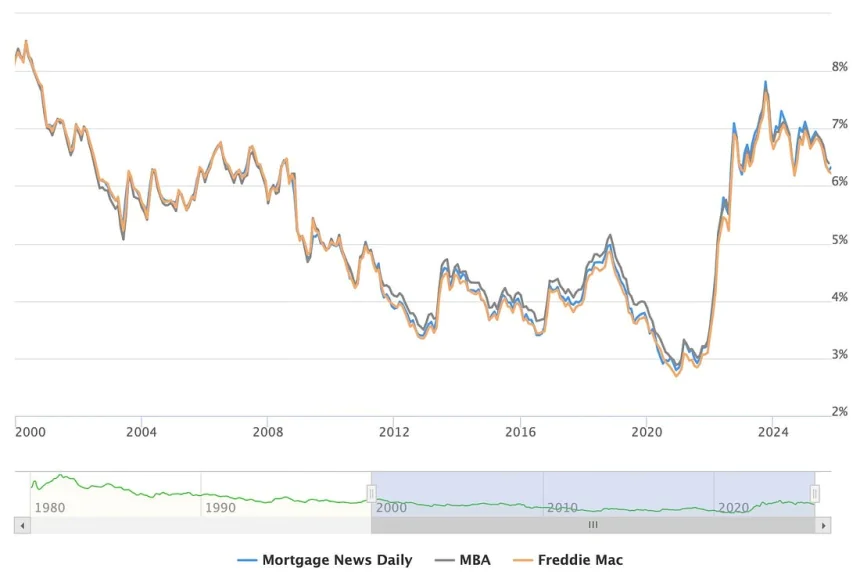

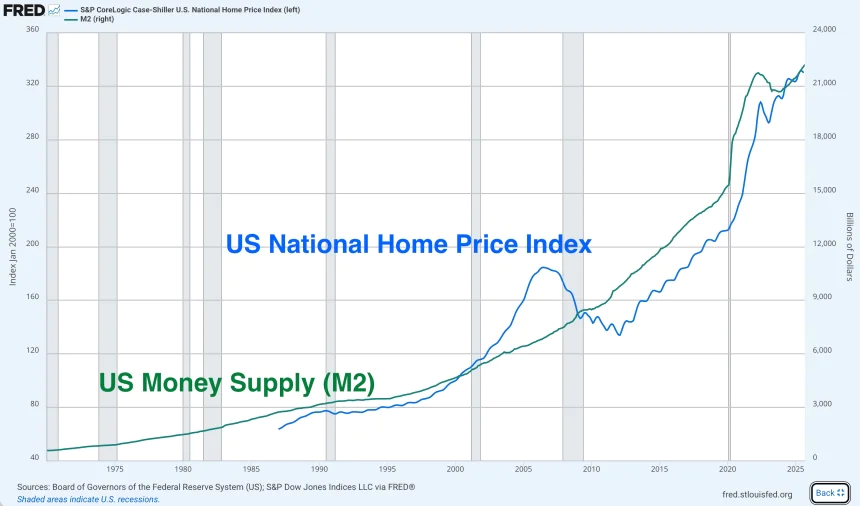

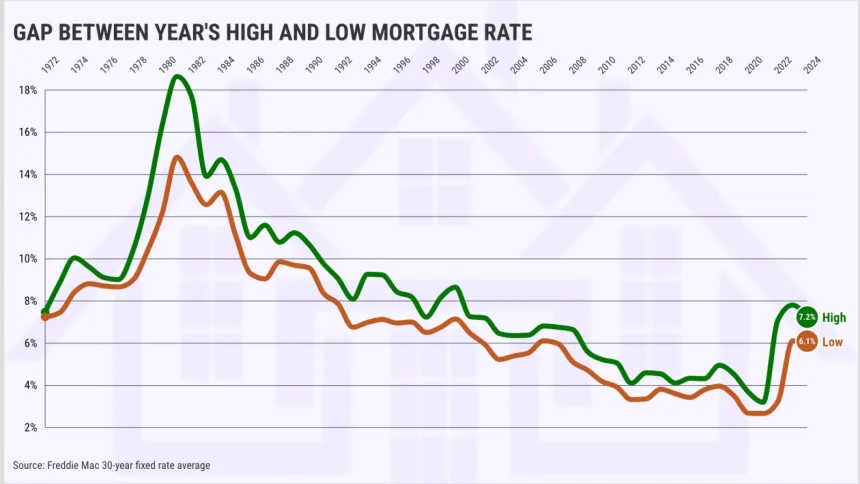

Home loan rates rarely sit still. They respond instantly to economic data, investor sentiment, and financial policy. When inflation rises, lenders demand higher returns. When investors feel cautious, mortgage-backed securities become riskier, and rates follow the same upward path. And when bond yields rise—especially the 10-year U.S. Treasury yield—mortgage rates usually aren’t far behind.

Several major forces influence daily rate movements:

Economic data releases.

Reports on inflation, employment, and consumer spending can shift the mortgage market within hours. A hot jobs report, for example, often pushes rates upward.

Federal Reserve policy.

The Fed doesn’t directly set mortgage rates, but its rate decisions shape borrowing costs across the entire economy.

Investor behavior.

When investors seek safety during riskier periods, mortgage bonds may become less attractive, forcing lenders to raise rates.

Overall risk tolerance.

Lenders adjust rates depending on how confident they feel about borrowers’ ability to repay.

Put together, these ingredients create a landscape in which rate home loans ebb and flow with remarkable sensitivity.

Fixed vs. Adjustable: A Decision That Defines Your Long-Term Costs

Most borrowers face an early crossroads: choose a fixed-rate mortgage or an adjustable-rate mortgage (ARM). The decision shapes your monthly payments for years.

A fixed-rate mortgage offers stability. Whatever happens in the wider market, your payment remains unchanged. This is the path many choose when they plan to settle into a home for a long time.

An adjustable-rate mortgage begins with a lower introductory rate but later adjusts according to market conditions. These loans appeal to borrowers who expect to move, refinance, or simply want to take advantage of lower early-stage payments.

Neither type is inherently better. The key is understanding your timeline and risk tolerance. Rate home loans are deeply personal decisions, shaped by your lifestyle as much as by economic conditions.

Why Two Borrowers Often Get Different Rates

One of the most confusing parts of shopping for a mortgage is discovering that two people with the same “market rate” might receive very different loan offers. That’s because the posted rate is only a starting point. Lenders adjust based on personal financial details.

Your credit score is often the biggest determining factor. A borrower with excellent credit is treated as a lower-risk investment and is rewarded with more favorable pricing.

Your debt-to-income ratio (DTI) shows whether your existing obligations leave enough room for a mortgage. The lower your DTI, the more confident lenders feel.

Your down payment can also shift your offered rate. A higher down payment can eliminate the need for mortgage insurance and lower your lender’s risk exposure.

Even the property type matters. Primary homes usually receive better terms than second homes or investment properties.

Understanding rate home loans isn’t just about watching national averages. It’s about understanding how your own financial profile interacts with the lender’s risk model.

How to Compare Rate Home Loans Without Falling Into Common Traps

Comparing home loan rates can feel like navigating a maze, especially when every lender promotes a glossy, attention-grabbing number. In reality, the best mortgage deal isn’t always the one with the lowest headline rate.

A wiser comparison begins with APR (Annual Percentage Rate), which includes interest plus fees. APR reveals a more complete picture of actual borrowing costs.

It also helps to compare quotes from different types of lenders. Traditional banks might offer stability, while credit unions often provide lower margins. Online mortgage platforms sometimes deliver aggressive pricing because of lower operating overhead.

Another key factor is the rate-lock period. If rates are trending upward, locking your rate early can save thousands over the life of the loan.

Borrowers often underestimate the power of shopping around. Even a 0.25% difference in a 30-year mortgage can mean tens of thousands saved over the life of the loan.

Is Now a Good Time to Apply for a Mortgage?

Trying to time the mortgage market is a tricky business. Interest rates rise and fall in waves, and predicting the next movement is difficult even for professionals. What matters most is your readiness.

If your income is stable, your credit is strong, and you know your budget comfortably supports a mortgage, then the “right time” becomes less about the national charts and more about your personal timeline.

Market shifts matter, but they shouldn’t overshadow your long-term financial stability. A home is a major commitment. The best time to act is when your financial life is aligned with the responsibility.

Why Information Matters More Than Rate Predictions

The future of mortgage rates often becomes a topic of speculation—some expect declines, others predict stubbornly elevated costs. Borrowers benefit far more from understanding the mechanics of rate home loans than from trying to guess what will happen next.

Knowing how lenders evaluate applications, how different loan structures work, and how your own financial fingerprint affects pricing gives you leverage. It’s not about beating the market. It’s about entering it prepared.

The more informed you are, the more confidently you can navigate rate quotes, negotiate terms, and choose the loan that fits your goals.

Closing Thoughts: A Clear Path Through a Complicated Market

Rate home loans will continue to rise, fall, and surprise borrowers. Markets shift. Sentiment changes. Economic signals conflict with each other. But while the environment may be unpredictable, your approach doesn’t have to be.

By understanding the structure of mortgage pricing, strengthening your financial profile, and comparing multiple lenders with a careful eye, you create your own stability in a volatile landscape.

Knowledge turns uncertainty into opportunity. And in the long story of buying a home, that might be the most valuable tool you can carry.

Share

What was your reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0