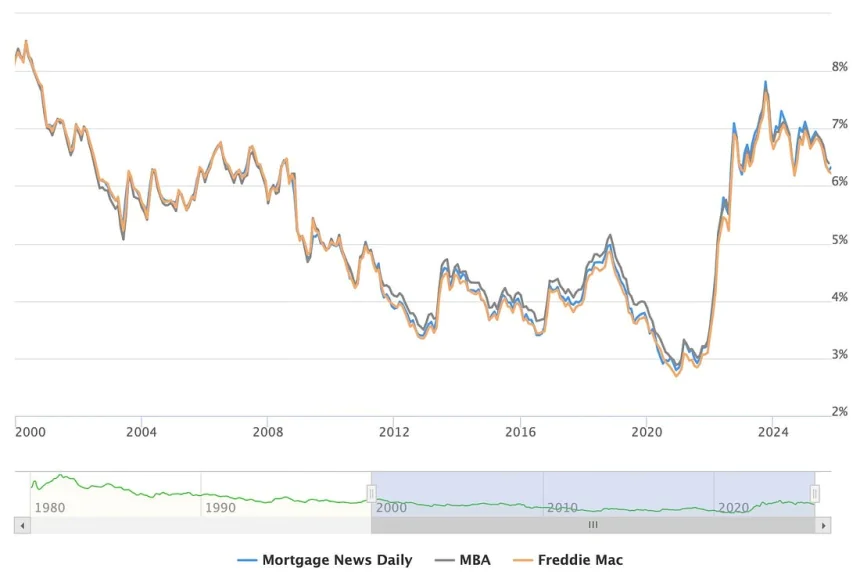

U.S. 30-Year Mortgage Rates Today (Nov 2025): What’s Driving Trends & How HELOC Rates Factor In

As of November 2025, 30-year fixed mortgage rates in the U.S. hover around 6.3%, while average HELOC (home equity line of credit) rates are around 7.6-7.8%. This article explores the current rate landscape, key drivers, and how prospective homeowners or refinancers should think about HELOCs. Source data and insights included.

In November 2025, the U.S. mortgage market remains in a transitional period. The average 30-year fixed mortgage rate sits around 6.3%, while HELOC (home equity line of credit) rates remain in the 7.6–7.8% range. These numbers reflect current economic data, rate-cut expectations, and shifts in borrowing behavior.

Current State of 30-Year Mortgage Rates

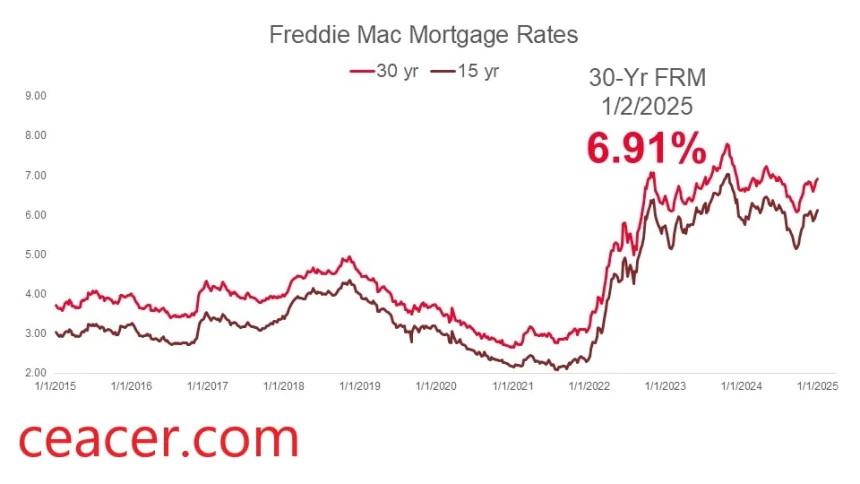

Recent Bankrate data shows that the 30-year fixed mortgage rate has moved slightly upward to 6.31%.

Source: https://www.bankrate.com/mortgages/analysis/mortgage-rates-november-5-2025/?=ceacer.com

Forbes Advisor lists the current 30-year APR at 6.34%.

Source: https://www.forbes.com/advisor/mortgages/mortgage-rates-11-11-25/?=ceacer.com

NerdWallet’s Zillow-based dataset places the rate at 6.12% as of November 13, 2025.

Source: https://www.nerdwallet.com/mortgages/news/mortgage-rates-today-friday-november-7-2025/?=ceacer.com

Despite slight variations, all sources align within a narrow band, indicating stability around the low-to-mid 6% mark.

What’s Driving These Rates?

Mortgage pricing is being influenced by several forces:

• Treasury yields: Mortgage rates track long-term government bond yields.

• Federal Reserve policy: Rate cuts earlier in 2025 continue to ripple through lending markets.

• Housing inventory constraints: Low supply limits volatility in demand.

• Borrower behavior: Many homeowners remain “locked in” with older sub-4% mortgages, reducing refinancing activity.

HELOC Rates in November 2025

HELOC pricing remains slightly higher than mortgage rates because most HELOCs use a variable structure tied to the prime rate.

Yahoo Finance reports average HELOC rates around 7.64%.

Source: https://finance.yahoo.com/personal-finance/mortgages/article/heloc-rates-today-tuesday-november-11-2025-110015382.html?=ceacer.com

Bankrate shows some lenders advertising starting APRs near 6.15%, depending on credit and property equity.

Source: https://www.bankrate.com/home-equity/heloc-rates/?=ceacer.com

CBS News notes that HELOC rates have trended downward over the past year due to easing monetary policy.

Source: https://www.cbsnews.com/news/how-low-heloc-interest-rates-dropped-past-year-2024-2025/?=ceacer.com

Underwriting matrices from Quorum illustrate lender spreads tied to prime, showing how credit score and CLTV influence final APR.

Source: https://3851812.fs1.hubspotusercontent-na1.net/hubfs/3851812/B2B%20HELOC/HELOC%20Rate%20Sheets/2025/March%2031%2C%202025/Second%20Lien%20HELOC%2003.31.25-1.pdf?=ceacer.com

Borrower Considerations

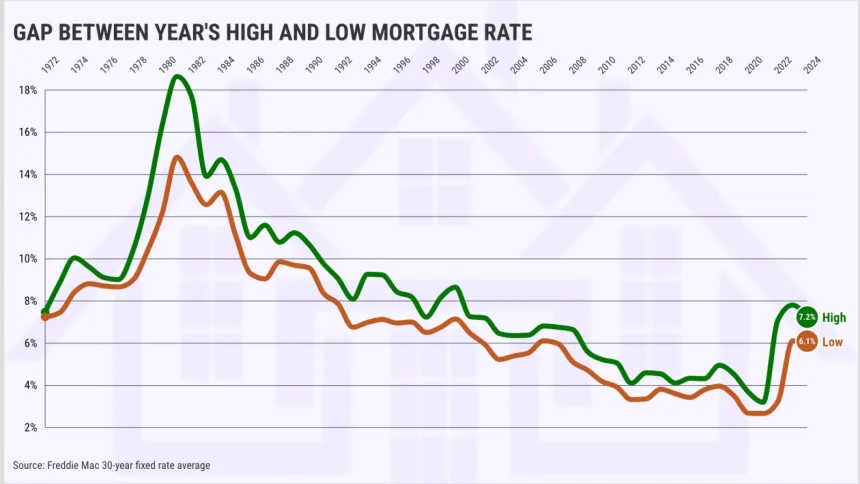

New homebuyers may find today’s 6.3% range acceptable, especially compared to 2023–2024 peaks near 8%.

Existing homeowners should only refinance for strategic reasons, such as cash-out needs or shortening loan terms.

HELOC seekers should note the most important distinction: rates can reset, especially once moving from draw period to repayment.

Outlook for the Coming Months

Market consensus suggests that:

• Mortgage rates could decline slightly if inflation continues cooling.

• HELOC rates may follow the prime rate lower — but not as fast or as dramatically as fixed mortgages.

• Treasury volatility remains the key wildcard.

Share

What was your reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0